The time of zero inflation is over and the world is seeing increasing costs and interest rates, so how do you manage this as a charity? Find out here.

As Bob Dylan once sang “The times they are a changin’ ” and with another interest rate rise on the horizon, it seems like an appropriate time to look once again at the subject of forecasting and finance.

Inflation is increasing rapidly, whatever method you use, and this means that charities will have to think about how they forecast both from a strategic point of view and from a practical standpoint.

So in this post, I wanted to give you a brief look at the things I am considering with the charities I work with and to give you some practical steps to take.

Contents

- Interesting inflation

- Don’t panic!

- What’s going to change?

- Embracing change

- Maybe it will, maybe it won’t

- How do you choose an inflation rate?

- Building in intelligence

- It’s not just you

- Some excel methods

- Don’t forget your income

- What if?

- Your step-by-step guide

1. Interesting inflation

I’m really old. So much so that my first day of work was in July 1979. Interest rates at that time were 14% and inflation was 13.42%.

You may be like me and remember the heady days of July 1982, when we had 8 interest rate changes in a month!

Far from being unusual, times when interest and inflation rates rapidly change are the norm. Indeed, the last five years have been a relatively quiet time in terms of interest and inflation rates, with both being historically low and rarely changing.

So if you’ve only just come into the world of finance, then turbulent times might be a bit of a surprise, and knowing how to deal with them could be a bit of a mystery.

2. Don’t panic!

So the first thing to say is that you should know what is going on, but you shouldn’t panic.

We’ve lived through these types of times before and we’ll get through them this time around. But we need to take some simple measures to make sure that we have a clear sight of what is important and so that we don't miss out on opportunities.

3. What’s going to change?

When things are moving quickly, it is tempting to think that you are standing on shifting sands and trying to hit a moving target (sorry for the mixed metaphor).

But probably the first place I start is to understand what can move, what can’t and what is in the middle.

For example, you may have an office that is rented on a long-term lease. Your payments will be set by the lease terms and can’t be changed until the next review date, so you know you don’t need to worry about them until then.

My first port of call when I am forecasting is to build in all the things I know will not change and then forget about them.

4. Embracing change

Then you have the things that you know are going to change. A good example of this at the moment is fuel prices. I know they are going to change, so what I will do is look to understand whether this matters.

One charity I work with doesn’t have any vehicles and only pays a small amount of mileage to one person. So the fact that fuel prices are changing is irrelevant in the grand scheme of things. In this case, I will build in a forecast based on last year’s numbers and accept I am going to be wrong, but that it won’t matter too much.

Another charity I work with has carers that visit clients in their homes and so they pay a lot of mileage to many people, so fuel prices are important and in this case I know I need to do a special forecast just for these.

5. Maybe it will, maybe it won’t

So, to a large extent, the last two categories are easy. If you know something will or won’t change, then you know how you have to deal with it, but what if you aren’t sure?

You’ll probably have a lot of questions here. Will the staff get a pay rise? Will our suppliers charge us more? Will we make more money on our investments?

In this case, I adopt a general inflation rate and apply it to all.

Now a word of warning here - you are going to be wrong. If you forecast inflation at 10% and it turns out to be 10.5% or 9.5% won’t really matter, but if you don't forecast at all, then your organisation could find itself in difficulty.

So being wrong isn’t a crime, but not bothering to engage with inflation is certainly questionable.

6. How do you choose an inflation rate?

This is, of course, the $64,000 question - What will the inflation rate be?

Well, the slightly messy answer is that not only does nobody know, but you may experience different inflation rates for different things!

Again, it is time to apply the ‘how much does it matter’ test.

If staff costs make up 95% of your expenses, then you’ll want to make sure you are doing a full forecast for wages and salaries and on-costs such as pensions, NIC and other benefits.

But if your expenses tend to be more evenly split, then you can apply a standard rate to everything.

The way you apply your rate and the thing it is applying to might change where you source your information from.

If you are applying a standard rate to everything, then you can use forecasts from respected institutions like the Bank of England monetary policy report or the Office for Budgetary Responsibility (OBR).

7. Building in intelligence

Bare statistics help a lot, but where you can really add value is by adding in intelligence from other sources.

As an illustration, think about energy prices in the UK.

We’ve seen a massive rise in prices, so if I was a heavy user I’d be looking at our historical usage and then forecasting with this.

But then I’d build in two things.

The first is our predicted usage by speaking with the business. Has anything changed that will mean we use more/less? Do we have new locations? Do we have a new energy efficiency policy?

The second thing I’d look at is what energy analysts are saying. At the time of writing (August 2022) prices are high but analysts predict they will skyrocket by January next year.

These two bits of information will tell me whether I need to revise my inflation rate for energy costs. Again, this isn’t an exact science, but the more you do it, the better you’ll get.

8. It’s not just you

It’s important to remember that when inflation hits, it hits everyone. So even if you think it may not affect you, you can bet it is affecting your staff and your suppliers.

This means that when you are thinking about how inflation will change things for you, it is worth thinking about what will happen upstream.

An example here would be an organisation that doesn’t have its own vehicles but relies upon couriers a lot.

Fuel price inflation won’t hurt them directly in the travel expenses line, but you can bet that their couriers will increase their costs. So when you are predicting your inflation rate, think also about how it might affect you indirectly.

9. Some excel methods

So how do we do this in practice? Well here are some of my favourite ways of allowing for inflation.

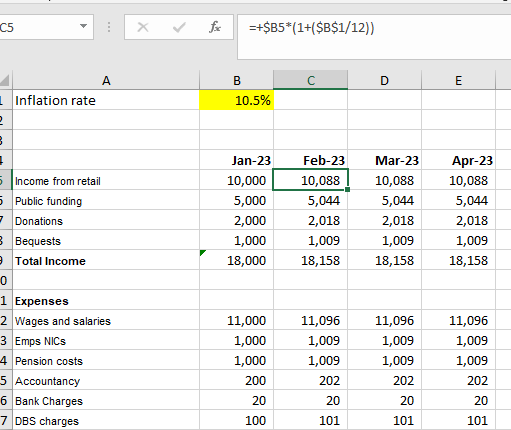

The overall rate

In this method, I’ve just used a single overall rate and applied it to everything.

It’s broad brush for sure, but it is also quick and easy and sometimes that’s the best way, especially when you have little time. In the image below, you can see that I have a single input cell (in yellow) and this affects all the forecast cells from February onwards.

Just remember that the inflation rate is annual, so I am dividing it by 12 and then applying it to the January number. You could, of course, compound this by applying it each month to the last month’s number. The choice of method is entirely up to you.

Of course, in real life, you probably wouldn’t change your prices on a monthly basis, but do be aware that in times of very high inflation, this is exactly what you would need to do.

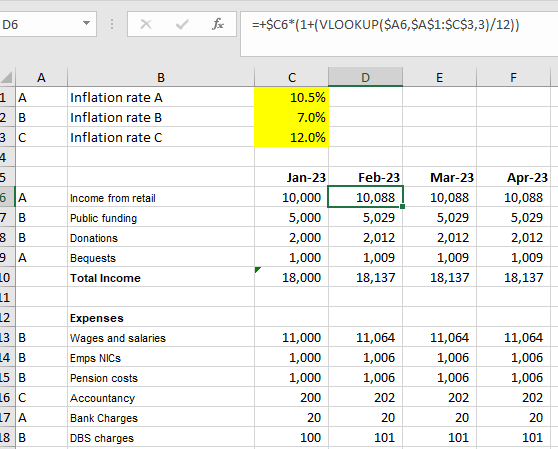

Rate categories

If you think different expenses will have different rates, then you can allocate them to categories like the example below.

There are loads of ways to do this, but in this example, I have used a VLOOKUP to find the rate based on my input in column A.

You don’t need to use a nondescript name like “inflation rate A” of course. You can use more descriptive phrases like people costs, establishment costs or supplier costs.

The aim is to apply a rate to cost lines that will act in the same way as one another.

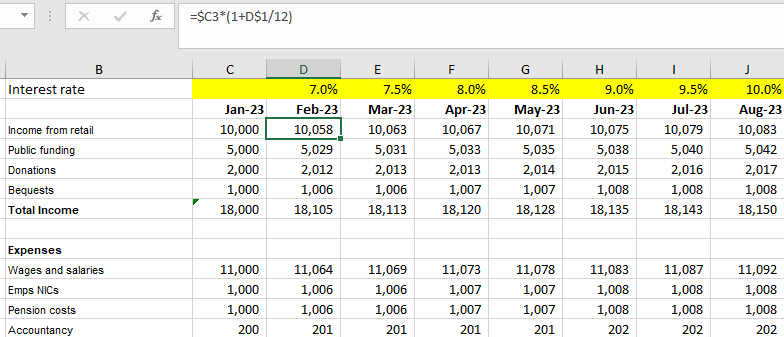

By Months

If you think that the inflation rate will change on a monthly basis, then you can forecast this with a different rate in row 4 like this:

Remember, these are only suggestions, so you may have a method that works better for you and that’s fine. In practice, most people use a bit of a blended method.

If you have a lot of different rates that you want to build in, then I’d suggest moving them to an assumptions page rather than having them on your report page as I have done above.

Be wary of trying to build in too much complexity. It is better to have a simple model that is finished in January than a complex model that is finished in the following November.

10. Don’t forget your income

Two points to make here.

The first is easy, and that is if you have interest or investment income, then naturally when interest rates change, then so will your inflow.

But for the last few years, this really hasn’t been a lot of money as interest rates have been tiny. Now it makes much more sense to think about treasury management and hunting around for the best deal.

The second point is about service pricing.

If you provide services to customers, then you will need to revisit your charging structure and contracting.

You’ll need to make sure that any contracts you sign include an inflationary increase.

And you will need to be certain you are providing services that aren’t costing you money. As your costs go up, the profitability of what you charge for goes down.

So beware if you find yourself locked into a contract that is costing you more to deliver than you are getting in return.

The charities I am working with are all making sure that they are pricing correctly and can adjust if inflation gets out of hand.

11. What if?

- What if you do your forecast and inflation is more than you expect?

- What if your primary supplier applies a 10% price increase?

- What if you have more income than you thought?

All these are valid questions, so this is the point at which consider scenario planning. Scenario planning is taking your original forecast and adding in some ‘what ifs’.

I start with a base forecast and then make copies of the page. Then I use the copies to flex my forecast based on things that could happen. Generally, I try to have a best case, worst case and something in the middle.

Again, remember that you are probably going to be wrong, but scenario planning gives you some visibility about what changes to inflation actually mean for your organisation in practice.

This is an excellent exercise to present to the trustees, as it highlights things that are the drivers behind your financial results.

12. Your step-by-step guide

I appreciate that’s a lot of information, so here’s a simple summary.

- Build in all the things you know will not change - if your rent won’t change in the year, then you don’t need to spend time forecasting.

- Work out which things aren’t important and build them in - big costs and things that move rapidly are important.

- Choose your method - are you going to do a quick and dirty single inflation rate and apply it to all? Or will you set rates for each account line?

- Build in your intelligence - get as much information from as many sources as you can to form a balanced view.

- Think about the indirect effects - will your suppliers increase their prices?

- Do a pricing review - are your services going to remain viable?

- Do a treasury review- is it worth being more proactive?

- Consider scenario planning - you can make it as simple or complex as you have time for

- Don’t panic - it’s times of change that make finance interesting and valuable.

Summary

Although it may feel like there’s a lot of uncertainty about, in fact, this is the usual state of affairs.

We’ve been spoiled recently by having very stable (and low) interest and inflation rates, so big swings are always a bit of a shock. The trick is to concentrate on the important things, things that will change rapidly and things that make a big difference to your organisation.

Good luck with your forecasting and remember - don’t panic!

Our thanks to our volunteer Stuart Walker for sharing his knowledge and insight on managing rising inflation.

About the author

Stuart Walker MBA, ACMA, is a business writer specialising in SaaS, Fintech and Financial Services. Stuart is a Cranfield Trust volunteer based in the South West of England and uses his accountancy and finance expertise and skills to guide our charity clients with all aspects of financial control, planning and forecasting.

Would you like some help with your charity's finances?

Cranfield Trust volunteers, like Stuart, help eligible charities with areas including cash flow forecasting, financial strategy, scenario planning and improving financial processes.

Don't delay, contact us today!

Cranfield Trust volunteers can not provide any advice on or review of investments, choice of investment/financial advisors or managers, bank accounts or other recommendations on services or products. Any areas regulated by the FCA: covered by the terms financial ‘advice’ which makes recommendations of specific financial products, or ‘guidance’ which gives information on different options, services or products.